Shanghai Unlock: is ETH going to Nuke?

Uh no. I struggle to think of who's going to sell ETH into USD. However, there will be interesting plays with LSD. Buying opportunities for alts as they dump.

You might not want to go through all the technicals to understand how withdrawals will work. Most folks only want to know if the price of ETH is going to dump. I think these are the facts most necessary to formulating a thesis on that question:

The Shanghai upgrade is tentatively set for March.

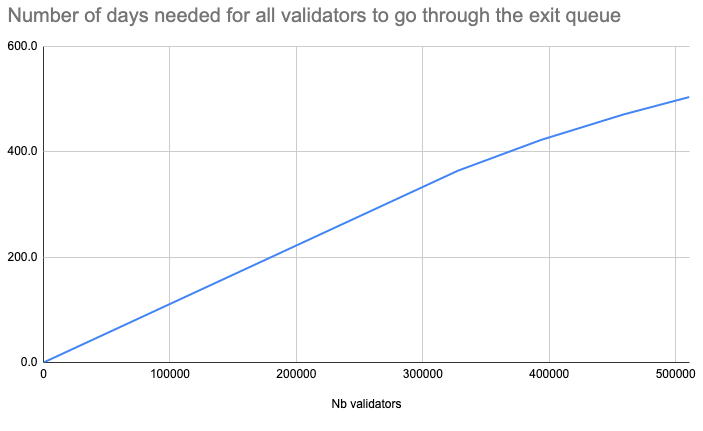

Withdrawals are queued. And will take a long time to complete. The withdrawal period is also dynamic.

There are two types of withdrawals: Partial and Full. A partial withdrawal is withdrawal of staking rewards; a full withdrawal happens when a validator exits and stops being a part of the beacon chain, taking away the staking rewards and the 32 ETh principal.

After the Shanghai upgrade, for a validator to be withdrawable, it must have a 0x01 credential. To change from 0x00 to 0x01, the BLS credential can sign a message and broadcast it to the CL. The operation to add 0x01 withdrawal credentials is rate limited to 16 operations per block.

If a validator’s withdrawal credentials are set to

0x01and point to a valid Ethereum address, then the partial withdrawal will happen automatically. Full withdrawals do not happen automatically.

Currently, around 20% of newly added validators do not set 0x01 credentials. This is probably because they are using old manuals or being guided by centralized institutions that have not updated their procedures.

Lido is currently the biggest user of the 0x01 credentialing system. They have set 88% of their withdrawal credentials and control more than 60% of the validators that are configured to receive automatic withdrawals.

On average, a validator in Lido's 0x01 credentialing system has earned 1.23 ETH in rewards. Lido has 131,016 validators set to 0x01 credentials. So that’s 160k ETH (approx. 256m) of automatic partial withdrawals.

What’s the market thinking?

The knee-jerk reaction to the Shanghai Unlock is of course: “Oh withdrawals! Eth will dump!”

A lot of reports seem to err on the side of downward price action for ETH. But I fail to see any strong reasoning beyond reflexive selling pressure from the anticipation of selling.

I think there are plenty of good reasons why ETH is not likely going to dump, and even if it does, it is not going to dump as hard:

If stakers need liquidity, they could just sell the LSD - even if they're shutting down their fund or have to repay loans. It doesn’t take the Shanghai Unlock for them to sell.

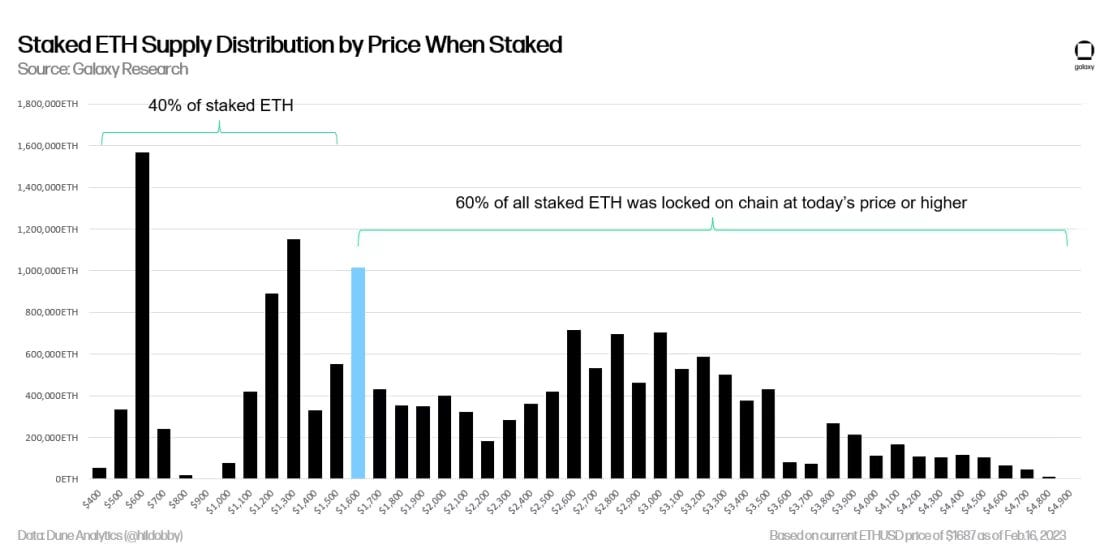

Most stakers are underwater. Why will they sell now?

Even if people rush to sell, the queuing mechanism will smoothen out the price chart.

If hoards of people unstake and sell to USDC, staking APY is going to jack up across the board and folks will ape back in.

Rotation from Lido into Rocketpool?

I am really struggling to think of who’s going to withdraw their ETH and sell it to stables. The folks who do so are either completing exiting from staking, perhaps to find better yield or returns elsewhere, or they’re exiting from crypto altogether. I am not convinced that there are better yields elsewhere at similar risks. The only case I can think of where folks will want to exit their entire stake is that they want to rotate into another LSD, say Lido into Frax or Rocketpool.

Out of all the LSDs most susceptible to mass exiting, is none other than the king of all LSDs - Lido.

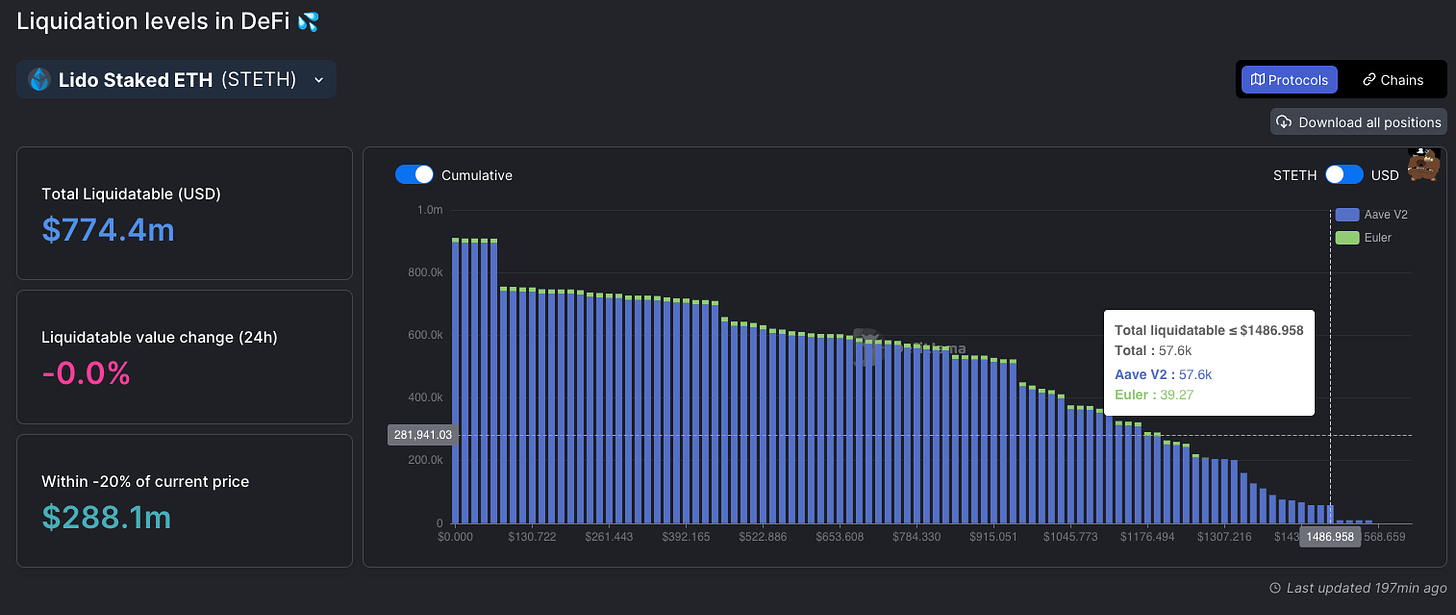

If stETH’s price drops below 1,480, we can see some 60k StEth (some $90m) being liquidated. If sufficient people want to exit stETH to rotate into other LSDs. StETH would have to be sold into ETH to repay loans, causing StETH to further depeg against ETH.

Rocketpool’s tokenomics allow node operators to run a node with fewer than 32 ETH. Node operators can deposit 16 ETH, which can then be paired with 16 ETH deposited by other folks in the deposit pool.

The likely reason why this is is simply because people are lazy and don’t want to run a node themselves.

Given withdrawals, Lido stakers might rotate en masse to Rocketpool, and once FrxEth has launched validator docs, Frax itself. The exodus of stakers from Lido into Rocketpool might see mass utilization of the following strategy.

Gearbox

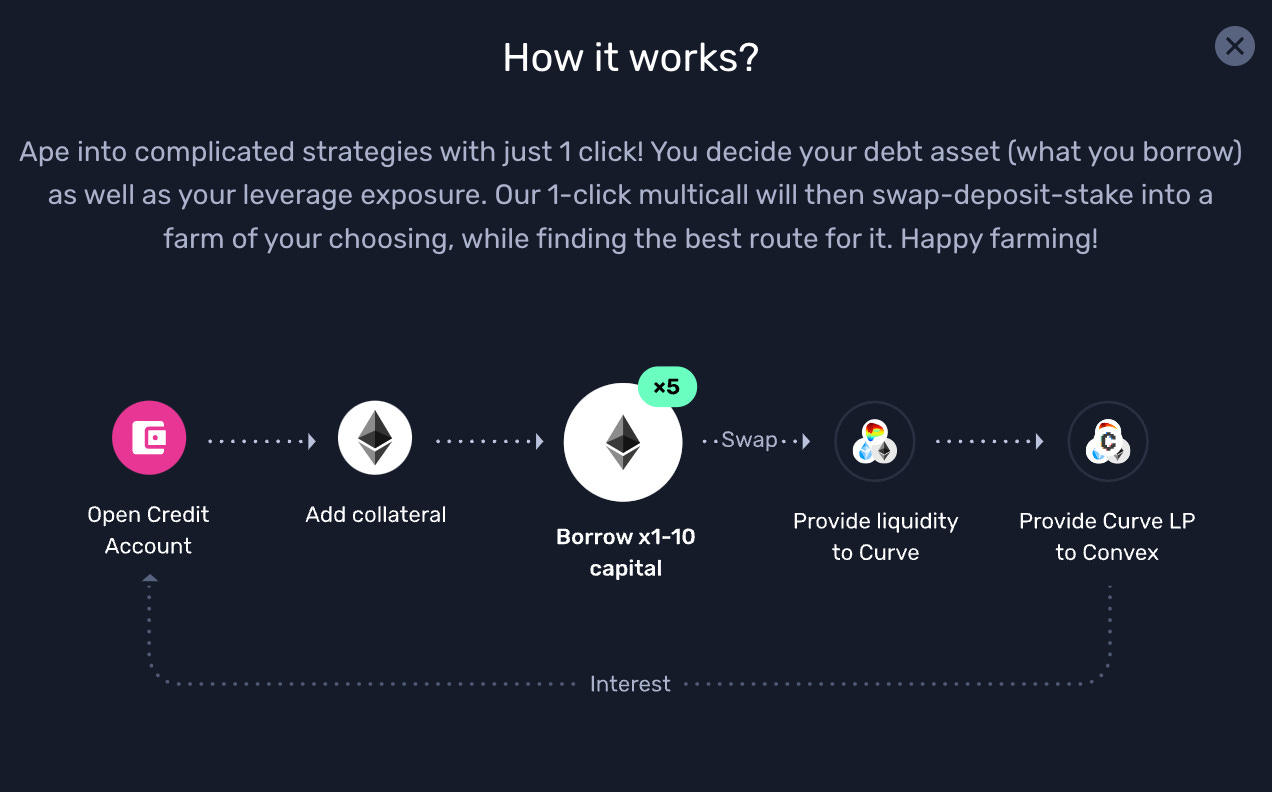

What is Gearbox? Gearbox markets itself as the “credit account primitive”. It is a super powerful idea. Each Credit Account in Gearbox Protocol has a predetermined liquidation threshold. If the account balance falls below this threshold, the position will be liquidated by third-party liquidators in a transparent and open manner. This feature enables Gearbox Protocol to provide decentralized leverage without having to verify whether the counterparty is a human or a bot, making it a simple yet elegant solution. Notice that this in theory would allow you to do a bunch of undercollateralised margin trading, just like on CEXes, because they monitor your whole account and can liquidate you.

The Credit Account allows users to borrow funds using their staked assets as collateral, similar to margin trading in traditional finance. The Credit Account is a unique feature of Gearbox that aims to leverage the power of composable DeFi protocols. By borrowing funds and reinvesting them in DeFi protocols, users can earn higher yields and increase their leverage.

DeFi is meant to be open and composable, but so far protocols are pretty segregated from each other. Leverage strategies cannot be easily unwound as you have to go through the individual protocols to unwind - much less liquidating! Gearbox uses an allowlist to list the set of DeFi protocols users can use under one account, all composable in a close environment. And if things go south, Gearbox can monitor your liquidity position and liquidate it if necessary, which is not possible with Compound or Aave-style lending markets. It's like a margin account on steroids.

Before it blew up, 3AC was looping with Steth and Eth. You deposit stEth on Aave, borrow Eth, stake it to get stEth, and deposit it again on Aave again. But all of this done manually, and when you unwind, you literally have return your Eth, take out your stEth, sell it for Eth, return it, and repeat. But with Gearbox, all of this could done with one click, as one strategy.

Check out GCR’s opinion on how the Shanghai upgrade is going to balloon the TVL on Gearbox.

Gearbox is offering this leveraging strategy on LSDs, and they’re calling it LLSD. So far only stEth and cbEth are integrated for this strategy, and we would eventually see rEth and frxEth integrated as well.

One can argue Euler Finance has been enabling this strategy for a while. Indeed, they have been very enthusiastic at pushing Frax to get the chainlink oracle necessary for listing sFrxEth as a collateral asset.

Although Euler offers one-click implementation of looping strategies as does Gearbox I would say $GEAR, which is now sitting on a market cap of just 15m, to be a superior exposure to the LSD trade than $EUL, which is sitting at an eye-watering 130m market cap, is superior a buy to those looking for a 5-6x. Furthermore, Gearbox’s strategic round tokens has 1-year cliff and 1-year linear vesting, so we won't be see dumping until 2023 Aug. Plenty of space and time to play the LSD narrative and TVL ballooning vis-a-vis Shanghai.

Yearn and yEth?

On 22nd March Yearn released a cryptic text that they’re getting into the LSD game.

If it were just another simple “stake with us and get a liquid token” it would have been very boring. But so far there hasn’t been any public release of information on what this thing even is.

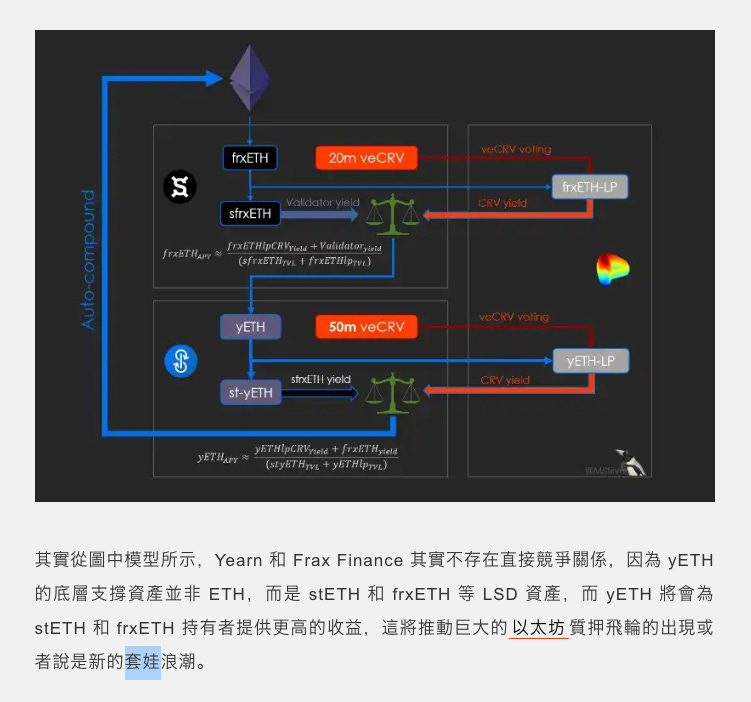

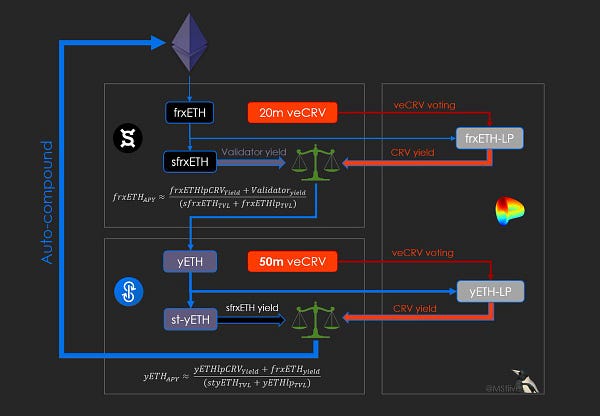

The only semblance of documentation on what yEth is is the following chart:

This picture is pretty cryptic, but basically I think it’s saying it will replicate frxEth’s structure on top of frxEth itself.

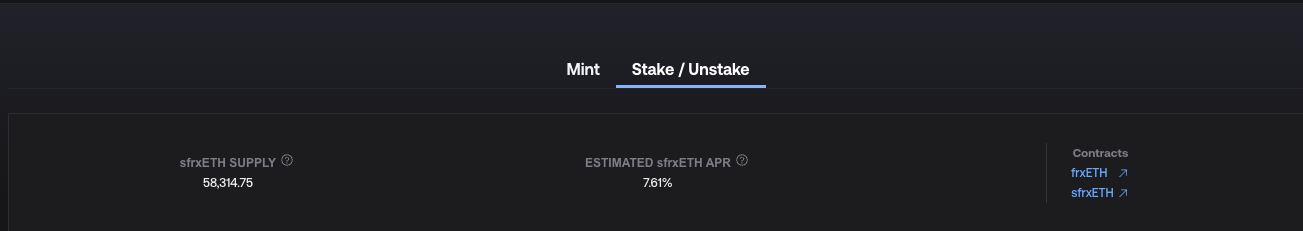

The frxEth and sFrxEth pair concentrates the right to access the underlying yield to sFrxEth to push up the sFrxEth yield. The frxEth is Eth already staked, but the frxEth holders who do not stake their frxEth to obtain sFrxEth are forgoing their yield. The yield is then distributed only to sFrxEth holders, so yield is concentrated and pushed higher. Check out my piece Diving into FrxEth if you’re not familiar with FrxEth’s mechanism.

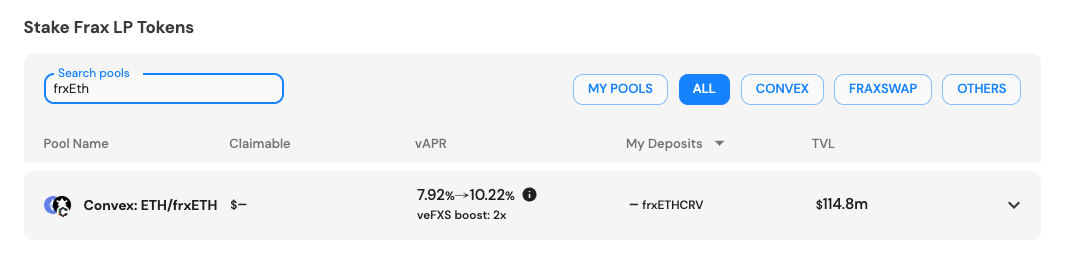

Assuming you have frxEth, you have two strategies before you. You can stake it intosFrxEth for 7-9% yield, or you can shove it into for frxEth-LP for 10-13% yield.

You can of course mix the strategies together, and the ratio of the strategies mixed will depend on your risk appetite and how you assess the risks involved with each appetite (validator failure for example).

This yields the likely yEth vault architecture.

You stake Eth into a yEth vault. The vault sends your Eth exactly into the strategy as outlined above: into a mixture of sFrxEth and frxEth-LP.

The vault mints you a yEth, but like frxEth it doesn’t immediately entitle you to the underlying yield. Instead, you can pair that yEth with Eth on Curve for yield - just like the frxEth-Eth pair.

This strategy would make sense only if yEth is pegged to Eth.

Alternatively, you can also choose to stake your yEth such that you can the underlying sfrxEth yield (or more? Perhaps the frxEth-LP yield as well? If this yield is just the sFrxEth yield I’d find it very strange. Why not just do sFrxEth and save the trouble?).

So, this architecture enables st-yEth holders to (1) earn sFrxEth yield, (2) frxEth-Eth LP yield, and yEth holders can earn yEth-Eth CRV emissions. But why stop there ser? This structure is self-similar. One can replicate this very structure on top of yEth again - the only prerequisite is that whoever’s building it must have a large warchest of crv for directing guages.

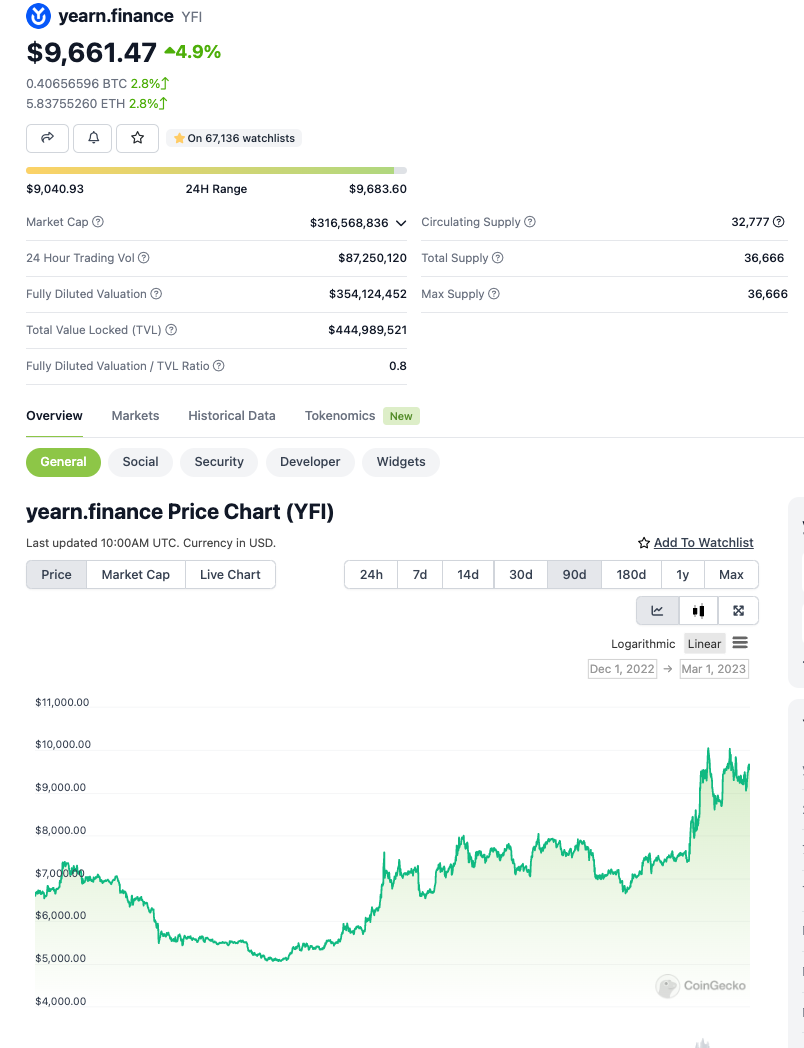

For some reason, reports and speculation on this new development on Yearn seems to be far more plentiful in the Chinese crypto community. And for such an exciting development, Yearn’s 300m mktcap does not seem ridiculously expensive.

Alt coins nuke?

If folks are expecting ETH to trend downwards, or if folks are looking to do event-driven trades in this Shanghai withdrawal, they would sell alts to hold dry powder. Arbitrum tokens, which pumped the most over the past 2-3 weeks, would be most prone to downward ETH action, especially tokens with limited adoption. The exhaustion of new launches on Arbitrum doesn’t help folks to stay hyper on the Arbitrum ecosystem either. I expect ecosystems orthogonal to Ethereum, such as Stacks and Canto, to also suffer, but probably not as directly as Arbitrum. Stacks in particular will damp more than Canto, as the ecosystem on Stacks is practically empty (22m TVL on a 1b chain!).

Dump no Eth

In conclusion, I think the Shanghai upgrade and the enabling of withdrawals are not likely going to have a significant impact on the price of ETH. There are opportunities, however, in $GEAR, and $YFI. Beware of staying in Alts, as folks rotate.

Resources

Jon Charbonneau: ETH withdrawal model

Exit queue can be monitored here:https://beaconcha.in/validators#exiting

More information on the withdrawals process:https://www.galaxy.com/research/insights/100-days-after-the-merge/

Example of real-time monitoring of withdrawals activity here: https://zhejiang.beaconcha.in/validators/withdrawals